The Budget Must Bring Hope

The ACDP believes that with God’s help the ship of public finances is turning in the right direction. Careful seamanship will, however, be required to deliver accelerated economic growth and create jobs.

Fiscal consolidation is, however, starting to bear fruit, with the primary budget surplus set to increase from R68.5 billion in 2025/26 to R224 billion in 2028/29, and debt set to stabilise at 77,9 per cent of GDP – albeit still at an unsustainable level. High debt service costs crowd out expenditure on other much-needed budget items, such as health, education and fighting crime and corruption. The debt stabilisation path must reduce public debt to more affordable levels over the medium to long term, with 60 per cent of GDP the maximum sustainable debt ratio recommended for an emerging market economy like South Africa’s. A fiscal anchor – such as an increasing primary budget surplus – is needed to weather global and domestic storms.

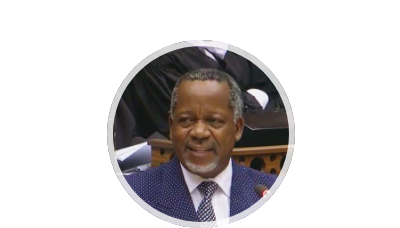

Minister Enoch Godongwana’s budget must bring hope to citizens who are fed up with high crime, poor education and poor health services – who are fed up with the water shortages and poor or no municipal services. Those who cannot find jobs to provide for their families. They rightfully demand tangible solutions.

Higher Economic Growth is Key

The solution to unemployment and poverty lies in higher economic growth. The economy is expected to only grow by 1,4 per cent in 2026/27 and by an annual average of 1,8 per cent over the next three years as power supply and logistics reforms are implemented. Much higher economic growth of between 3 and 5 per cent is required to solve the unemployment crisis. Further structural reforms to alleviate constraints in energy, transport and logistics, water and visas will speed up economic growth prospects. Local government reform also requires urgent attention, given severe service delivery challenges at this level.

How we deal with our major trade partners including the US and the EU as well as new markets such as China will also impact how fast we can grow the economy. Despite the extension of AGOA by the US until 2028, the US 30 per cent tariff still applies in the absence of a bilateral trade agreement. Existing tensions between South Africa and the US, caused mainly by our alignment with adversaries of the US, including Russia, China and Iran, will make such a trade agreement exceedingly difficult.

Increased private fixed capital investment will accelerate economic growth, but is lagging due to low business confidence, with companies sitting on more than R1.8 trillion cash reserves. Businesses have been hesitant to invest in the local economy due to rampant crime, policy uncertainty and political instability. Unlocking these funds is largely reliant upon a safe, stable political and economic environment – with reliable power supply, logistics, and water supplies. Reforms to boost private investment in public infrastructure by improving project execution and investment planning at government are to be welcomed. We trust that relative political stability within the Government of National Unity (GNU) will also result in improved business confidence and increased private sector capital investment.

We trust that this Budget will include higher than consumer price index increases of social grants as there is a critical need for significant increases in social welfare grants with many poor households struggling to even put food on their tables.

Reduce Irregular, Wasteful and Unnecessary Expenditure

The ACDP has also consistently called for a reduction in irregular, wasteful and unnecessary government expenditure, and we trust that the many spending reviews conducted by National Treasury over the years will now be implemented, including the removal of ‘ghost’ workers in the civil service. We welcome the Early Retirement Programme, particularly for the SANDF, to reduce the spiralling public sector wage bill. At the same time, we cannot afford to lose experienced and skilful public servants, such as doctors, nurses, detectives, prosecutors, and others manning critical frontline services.

The good news is that we expect a tax windfall due to the massive increase in gold and Platinum Group Metals prices. This, together with improved tax collection (which is expected to exceed projections by about R19bn), should mean that there will be no increases in private, corporate or VAT tax rates, as envisaged in last year’s Budget. We believe that there will be some tax relief for hard-pressed taxpayers from bracket creep. We also expect the standard increases in the fuel and RAF levies, as well as on ‘sin’ taxes such as alcohol and tobacco. More urgent steps are needed to address the illicit trade of alcohol and tobacco products which are estimated to cost the fiscus an estimated R30 to R50bn per year in lost tax revenue. We welcome the proposal by National Treasury for a national tax (in addition to existing provincial taxes) on gross gambling revenue (which could at 20 per cent potentially raise an additional R10bn) as an additional ‘sin’ tax to curb addictive and uncontrolled online gambling.

Soldiers on the ground to support the police in fighting crime is to be welcomed. It’s time to uproot, destroy and pull-down criminal syndicates. Criminals, including corrupt police generals and politicians, must be put behind bars. Now is the time to rebuild the moral fibre of our nation and to restore law and order. Only then will people begin to feel safe in their homes, in schools, at work and in public places. Only then will state funds be spent on critical services and not looted and stolen. Only then will foreign investors feel it is safe for long-term investments in the country.

Taxpayers Demand Value for Every Rand of Tax They Pay

Taxpayers are rightfully demanding value for every rand of tax they pay. They want to see servant leaders who understand the principle of stewardship of state resources. This they have not seen to date with the ANC’s looting, corruption and mismanagement. This budget must bring hope for a better tomorrow with tangible solutions.